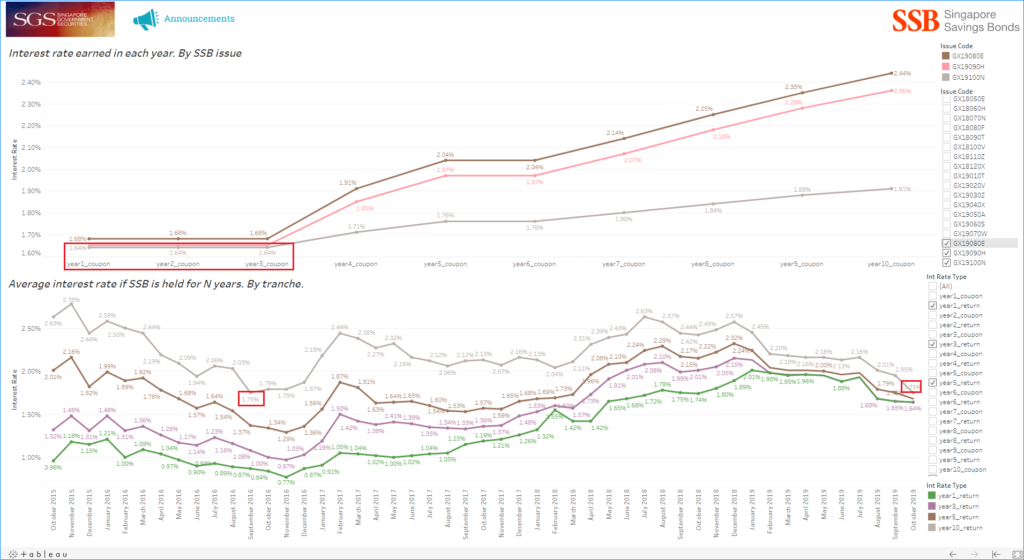

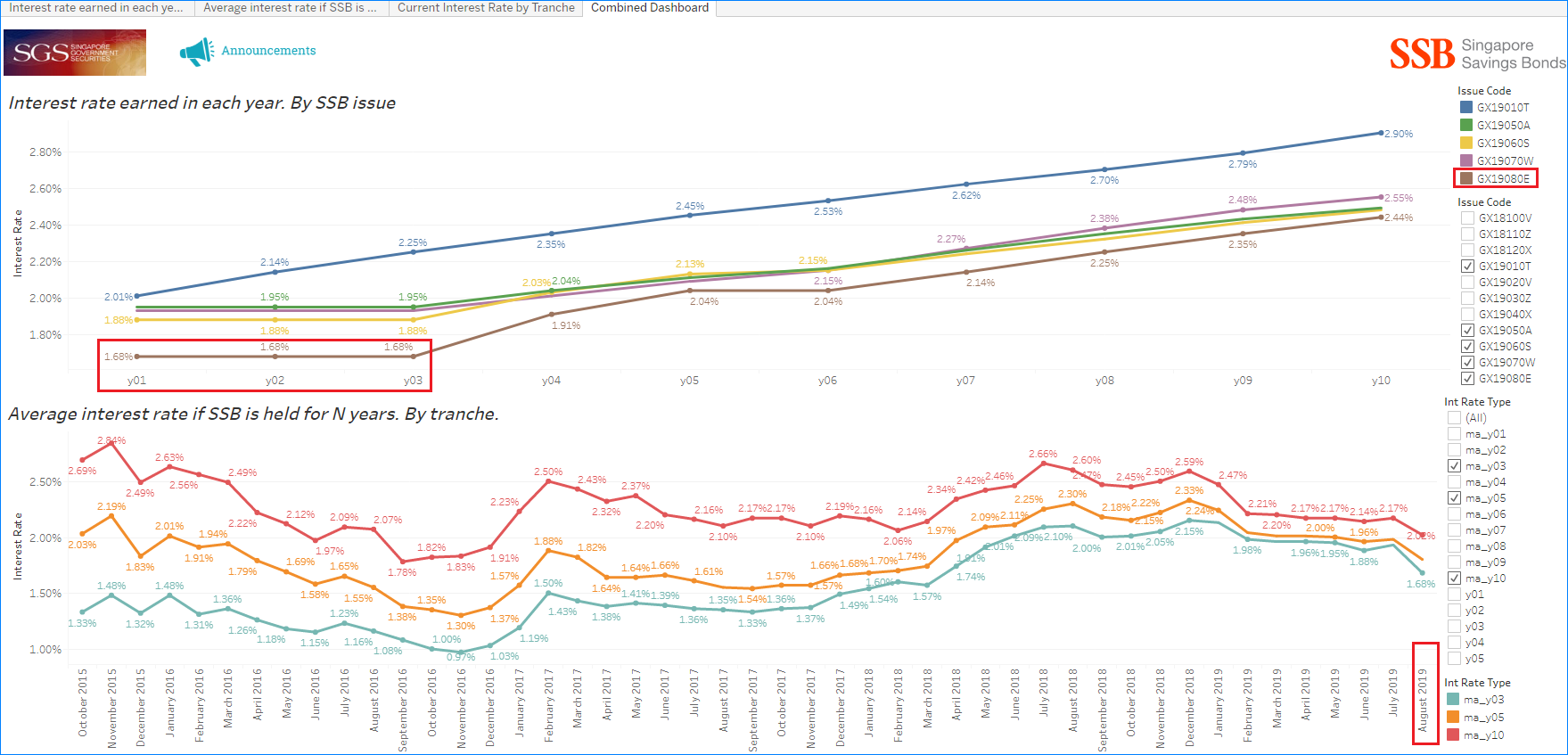

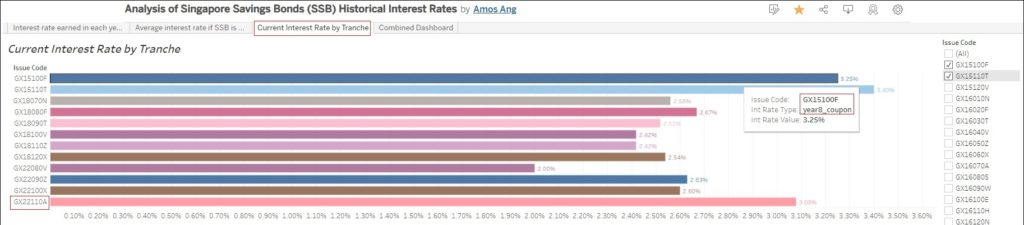

Singapore Savings Bonds (SSB) are all the rage again, after the Nov 2022 tranche reached historical highs for the 10-year average yield. Both the mainstream media and the local financial blogosphere have been abuzz with coverage on SSBs, as their interest rates kept achieving new highs, month after month. The incessant news coverage prompted me to relook at SSBs once more, as an investment vehicle.

Immediately, I was faced with …

![How to save an additional 5% (and more!) at COMEX 2019 by doing a FavePay-GrabPay-UOBCreditCard payment chain [5-8 Sep 2019 only!]](https://amosang.com/wp-content/uploads/2019/09/piggy-bank-2889042_1280-1170x702.jpg)